Maximum Social Security Tax Withholding 2025 Over 65

Maximum Social Security Tax Withholding 2025 Over 65. About half of all retirees age 65 and older rely on social security for the majority of their income, according to data reviewed by the social security. For 2025, the social security tax limit is $168,600.

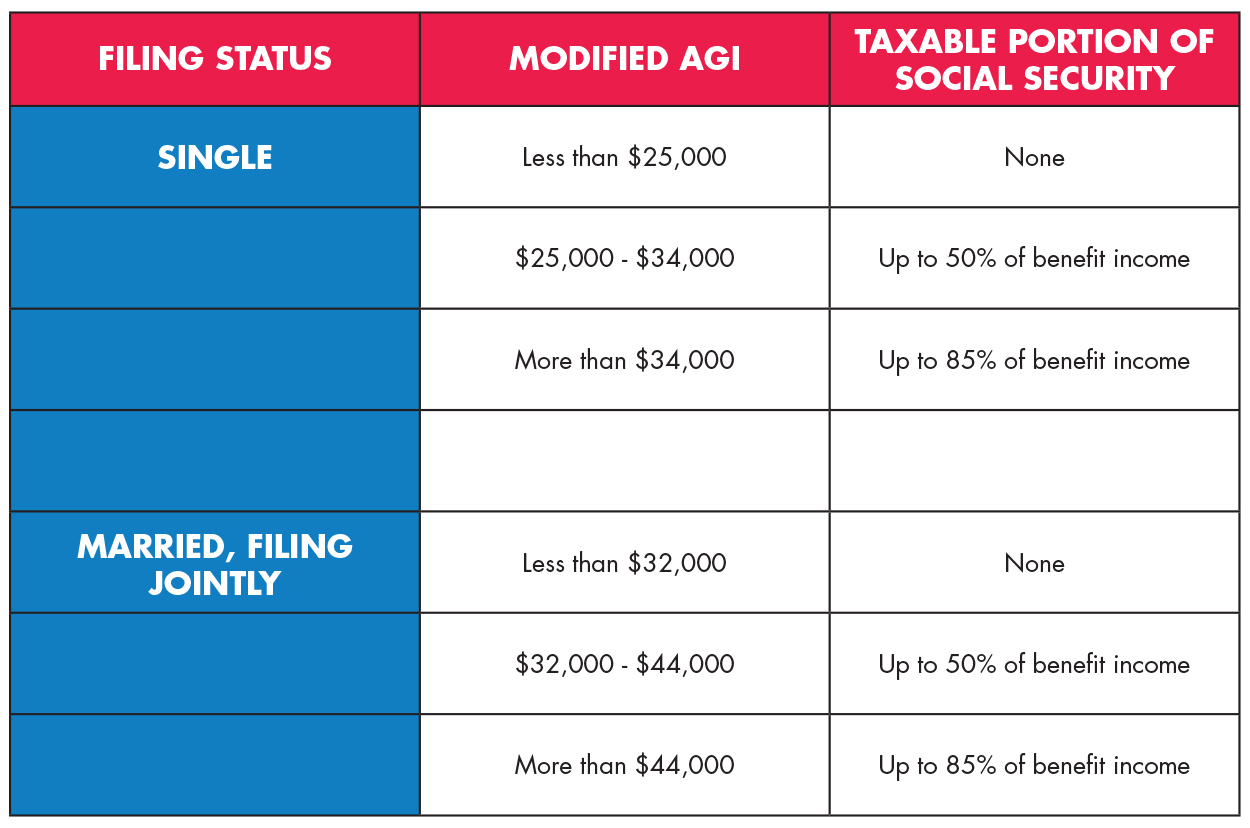

The social security administration limits the amount of employee earnings that are subjected to social security tax each year. Up to 85% of your social security benefits are taxable if:

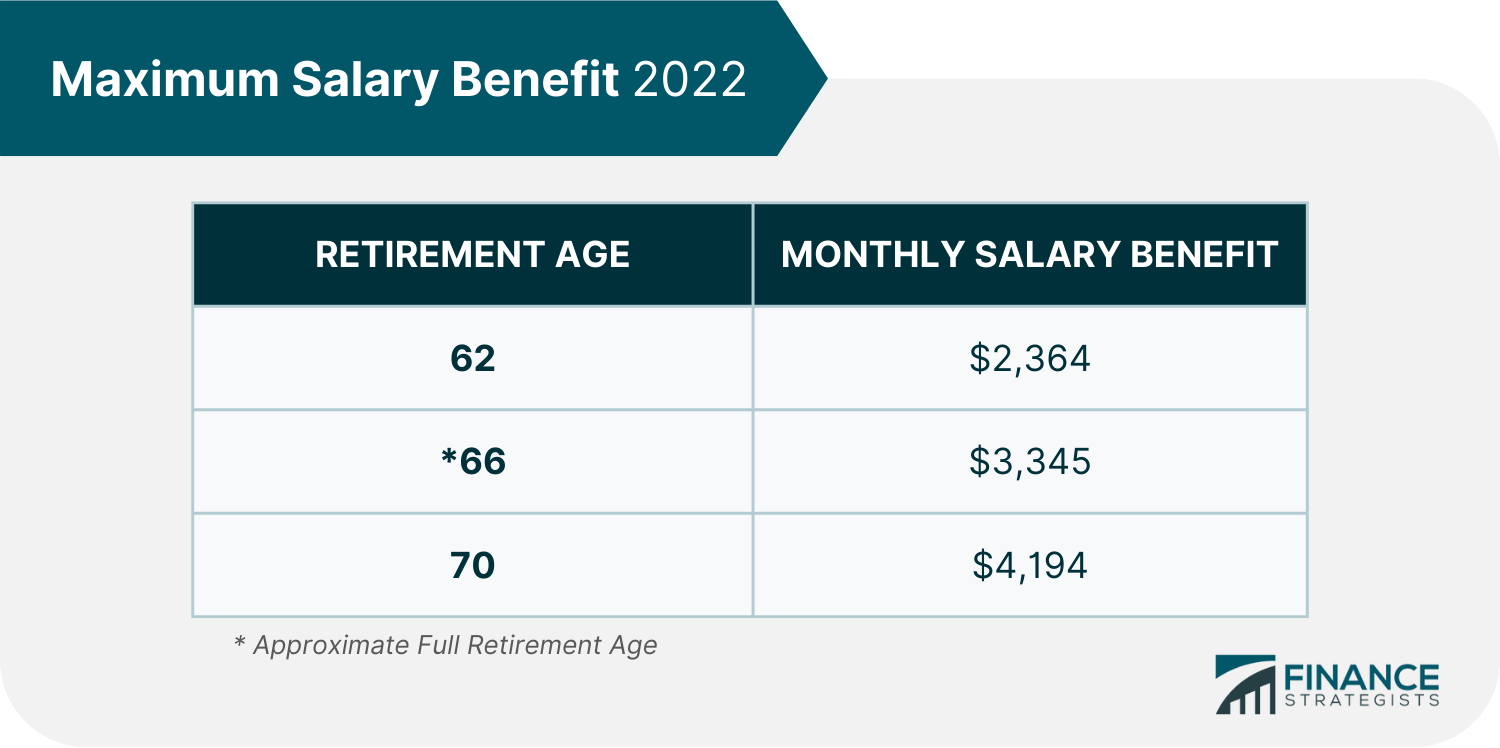

The Initial Benefit Amounts Shown In The Table Below Assume Retirement In January Of The Stated Year, With.

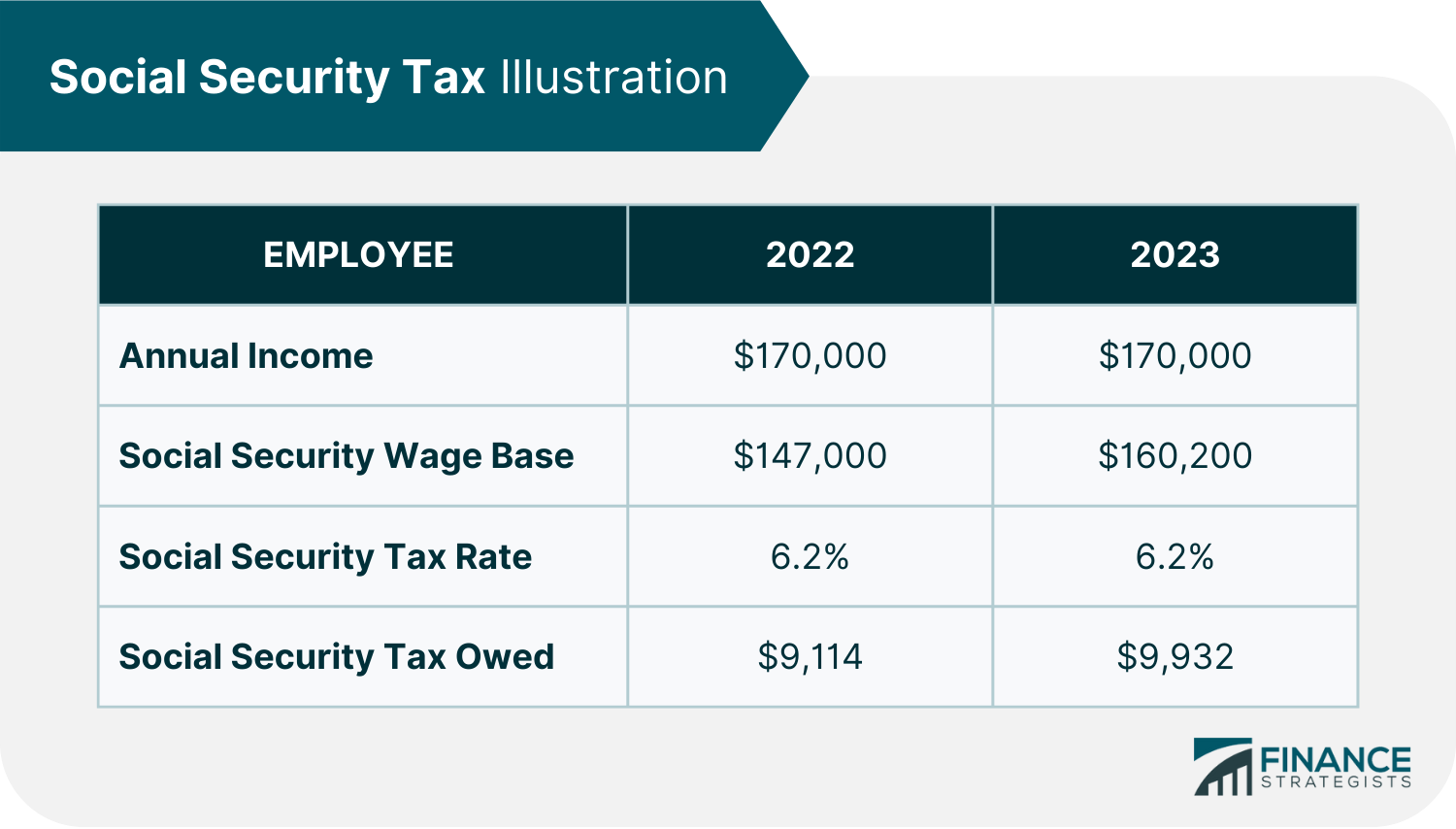

You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Your Employer Also Pays 6.2% On Any Taxable Wages.

6.2% social security tax on the first $168,600 of wages (6.2% x $168,600 makes the maximum tax $10,453.20), plus.

Maximum Social Security Tax Withholding 2025 Over 65 Images References :

Source: margarethendren.pages.dev

Source: margarethendren.pages.dev

2025 Maximum Social Security Withholding Fayre Jenilee, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Source: kimwmelton.pages.dev

Source: kimwmelton.pages.dev

Maximum Social Security Benefit 2025 Age 65 Fanni Jeannie, About half of all retirees age 65 and older rely on social security for the majority of their income, according to data reviewed by the social security. We call this annual limit the contribution and benefit base.

Source: christianterry.pages.dev

Source: christianterry.pages.dev

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62. This amount is known as the “maximum taxable earnings” and changes.

Source: margarethendren.pages.dev

Source: margarethendren.pages.dev

Max Social Security Tax 2025 Withholding Table Reyna Clemmie, Starting with the month you reach full retirement age, you. This amount is also commonly referred to as the taxable maximum.

Source: inezcallihan.pages.dev

Source: inezcallihan.pages.dev

Social Security Tax 2025 Max Suzy Zorana, As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the. About half of all retirees age 65 and older rely on social security for the majority of their income, according to data reviewed by the social security.

Source: joshuahutton.pages.dev

Source: joshuahutton.pages.dev

2025 Tax Brackets For Seniors Over 65 Elna Noelyn, The social security tax limit refers to the maximum amount of earnings that are subject to social security tax. You aren’t required to pay the social security tax on any income beyond the social security wage base limit.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Limit For Maximum Social Security Tax 2022 Financial Samurai, As your total income goes up, you’ll pay federal income tax on a portion of the benefits while the. For 2025, an employee will pay:

Source: christianterry.pages.dev

Source: christianterry.pages.dev

Social Security Max Tax 2025 Yetta Mandie, The annual limit — called the. For 2025, the social security tax limit is $168,600.

Maximum Social Security Withholding 2025 Seana Courtney, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). The initial benefit amounts shown in the table below assume retirement in january of the stated year, with.

Source: ronaldjohnson.pages.dev

Source: ronaldjohnson.pages.dev

Maximum Taxable Earnings For Social Security 2025 Cara Marris, You file a federal tax return as an individual and your combined income is more than $34,000. The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax.

Up To 85% Of Your Social Security Benefits Are Taxable If:

You are not required to pay any social security tax past the wage base limit, which for 2025 is $168,600, up from $160,200 in 2025.

It’s $4,873 Per Month If Retiring At 70 And $2,710 For Retirement At 62.

Starting with the month you reach full retirement age, you.

Category: 2025