Massachusetts Property Tax Rates By Town 2025

Massachusetts Property Tax Rates By Town 2025. This is an increase of $0.54 per thousand over the fy 2024 rate. The town of dalton, massachusetts.

This report shows the current and historical average single family tax bill for all cities and towns, including where the average falls (ranked highest to lowest) in the commonwealth. Due to years of strong new growth increases, the city’s.

Massachusetts Property Tax Rates By Town 2025 Images References :

Source: haleyybabbette.pages.dev

Source: haleyybabbette.pages.dev

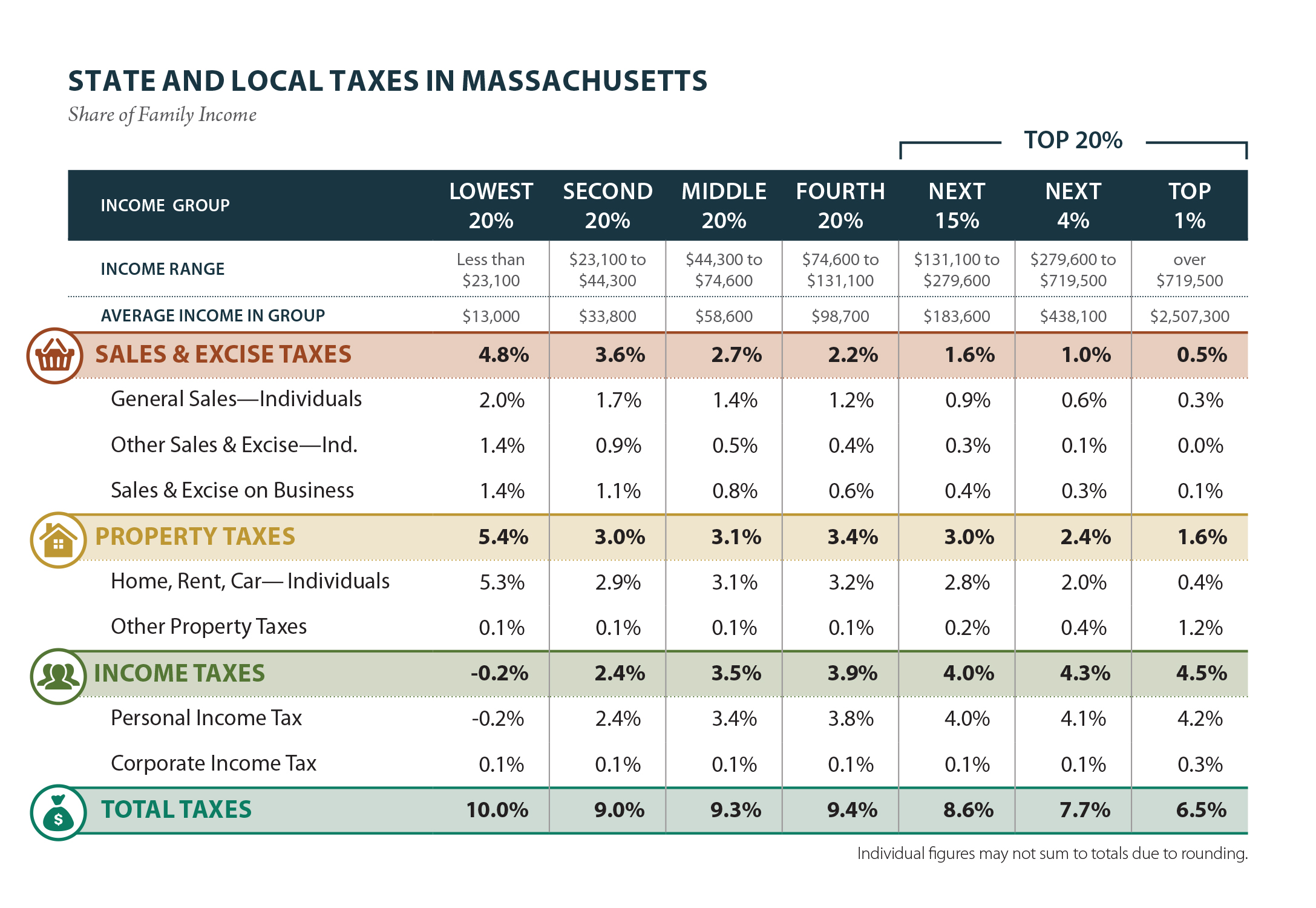

Ma Estate Tax Rates 2025 Grata Mathilde, Use the property tax calculator below to compute your massachusetts property taxes.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Property Tax Massachusetts By Town PRORFETY, Commercial, industrial, and personal rates are $25.27 for every one thousand dollars.

Source: joeshimkus.com

Source: joeshimkus.com

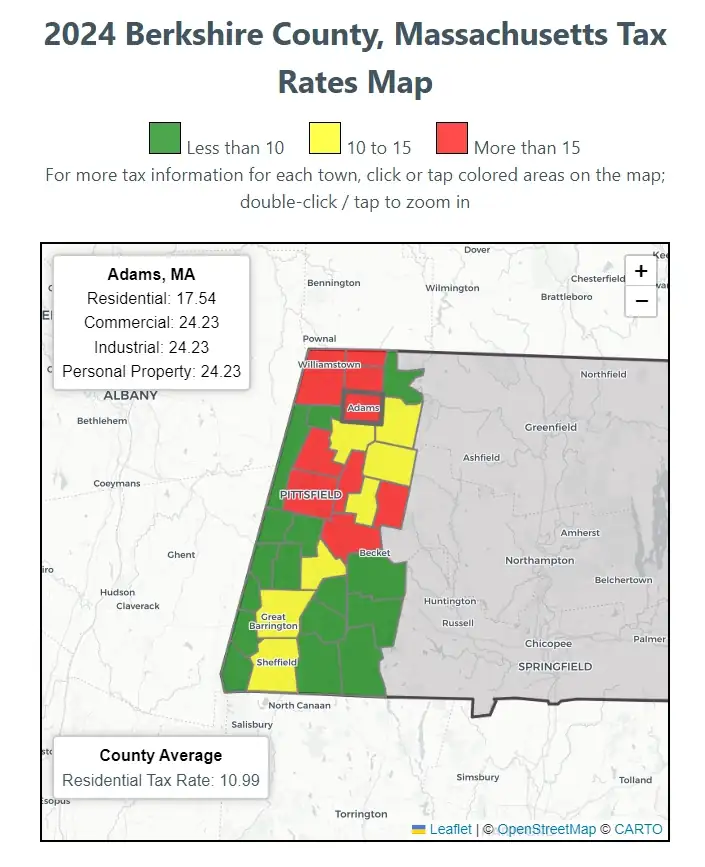

2024 Berkshire County Massachusetts Property Tax Rates Map Includes, Massachusetts property tax rates vary by town.

Source: storage.googleapis.com

Source: storage.googleapis.com

Property Taxes In Massachusetts By Town at Erica Jacobson blog, This year is no exception, with the median residential tax rate among all massachusetts cities and towns this year set at $12.81 per $1,000 in assessed value.

Source: northofbostonlifestyleguide.com

Source: northofbostonlifestyleguide.com

Massachusetts Property Tax Rates NORTH OF BOSTON LIFESTYLE GUIDE™, Due to years of strong new growth increases, the city's.

Source: www.caliper.com

Source: www.caliper.com

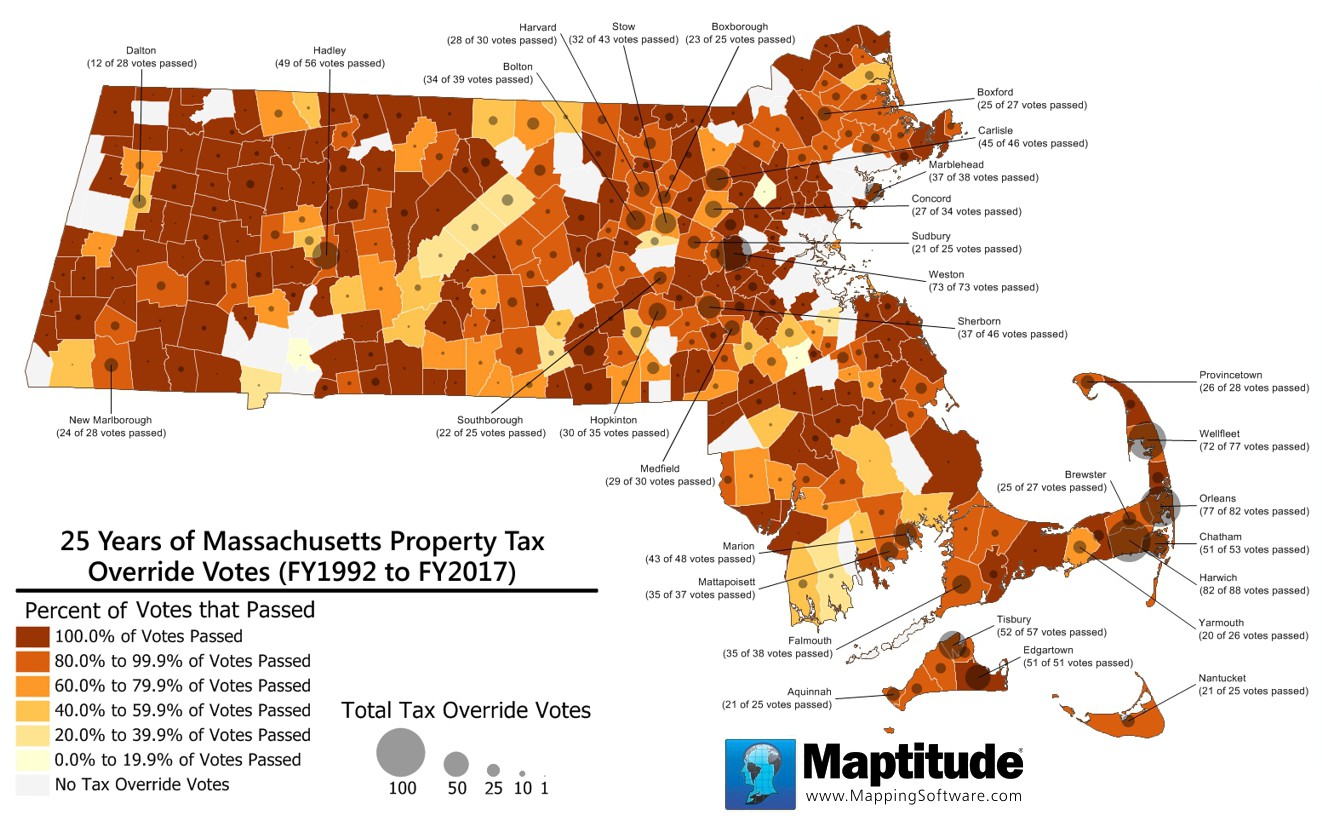

Maptitude Map Massachusetts Property Tax Override Votes, Massachusetts property tax rates vary by town.

Source: taxfoundation.org

Source: taxfoundation.org

Property Taxes by State & County Median Property Tax Bills, In fy24, the residential tax rate is $10.90 for every one thousand dollars of value.

Source: andeeebpennie.pages.dev

Source: andeeebpennie.pages.dev

Mass State Tax Rate 2025 Deana Estella, Use the property tax calculator below to compute your massachusetts property taxes.

Source: www.xoatax.com

Source: www.xoatax.com

Massachusetts Property Tax A Complete Guide 2024, This is an increase of $0.54 per thousand over the fy 2024 rate.

Source: cosasmayas.blogspot.com

Source: cosasmayas.blogspot.com

massachusetts real estate tax rates by town Very Strong EJournal, Fiscal year 2023 tax rate $12.58 per thousand;

Category: 2025